A Closer Look at Blue Cross Blue Shield of Michigan’s Small Employer Premium Trends

Sandy Fester, VP of Middle and Small Group Business

| 2 min read

Sandy Fester is vice president of Middle and Small G...

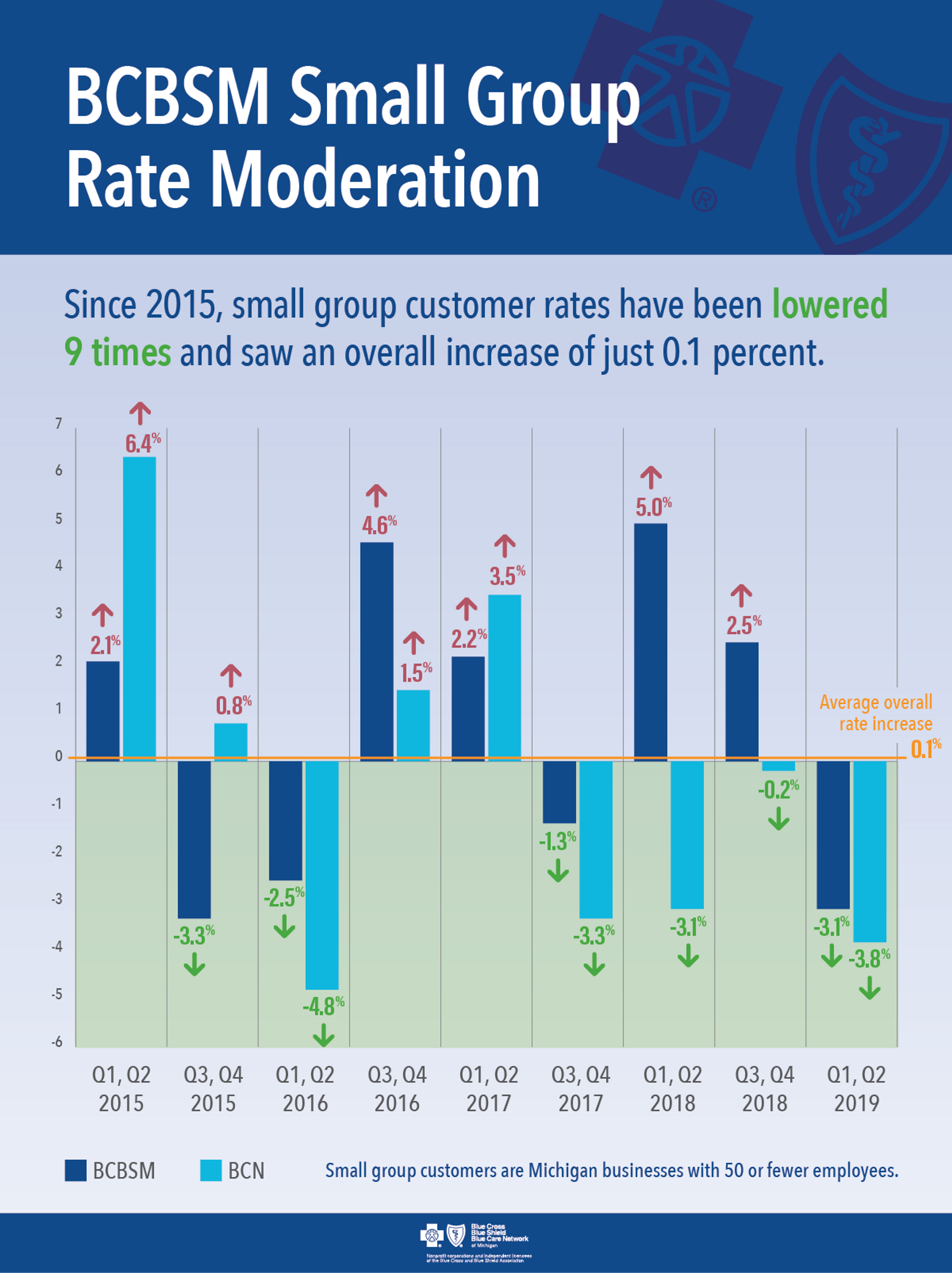

For the operator of a small business, the decision to offer health coverage for employees can be a difficult one. The expense of health benefits can pressure the bottom line, especially if business slows, and it can affect practical decisions, like whether to hire one more person. This is why Blue Cross’ work to moderate premiums for small businesses – keeping coverage affordable and the expense predictable – is an achievement I’m proud to talk about. Michigan is home to more than 870,000 small businesses employing just under 50 percent of the state’s private workforce, around 1.8 million people. Of those businesses, only 33 percent provided employee health benefits in 2017. As the state’s largest health insurer, we know how important it is for these employers to not only be able to offer their employees health care coverage, but to also provide them with affordable options. We’ve remained focused on moderating small employer premiums, with nine rate reductions in the last four years. Since 2015, our small employer PPO members have seen an average increase of less than one percent, while HMO members saw an average premium reduction of approximately one percent. And we know they appreciate the effort – as 93 percent of Blue Cross and Blue Care Network small employer customers renewed their coverage with us. Twice a year, Blue Cross calculates new rates for our small group members. In the first and second quarter of this year, we were able to provide them with a rate reduction across the board for PPO and HMO products – 3.1 percent and 3.8 percent lower premiums, respectively. These adjustments are in stark contrast to national numbers, where insurers have put forward an average annual increase of at least five percent since 2013. So, what’s different in Michigan? How is Blue Cross able to deliver this level of affordability? Our efforts to maintain premiums include more than 10 years of work by Blue Cross, Michigan doctors and hospitals to improve the efficiency of health care, as well as new programs designed to enhance member well-being and convenient access to care such as Virtual Well-Being and telehealth options. Affordability of premiums relies, in large measure, on the impact a private insurer can have on the root cost of health care services. Working collaboratively with Michigan’s best doctors and hospitals to promote better patient outcomes and manage costs is having a tangible impact. We’re happy it’s put us in the position of returning the money we are saving to our customers in the form of lower rates.

Photo credit: shapecharge