A Guide to Understanding Your Deductible

Blue Daily

| 2 min read

Many of us don't understand basic health care terms. In fact, only 12% of Americans have proficient health literacy skills, according to the National Assessment of Adult Literacy. Your finances and even your overall health may take a hit if you are part of the 88% of people who struggle with health literacy.

When you signed up for your health insurance plan, you likely took into account how much you wanted to pay each month, which was a factor in determining which health plan fit your needs and budget. And with your plan came countless health insurance terms used to describe the various costs, such as ‘coinsurance’, ‘premium’ and ‘copay’, that may not always be easy to understand. Read more on those terms and others here. Let's walk through one of those basic terms and learn more about deductibles.

What is a deductible?

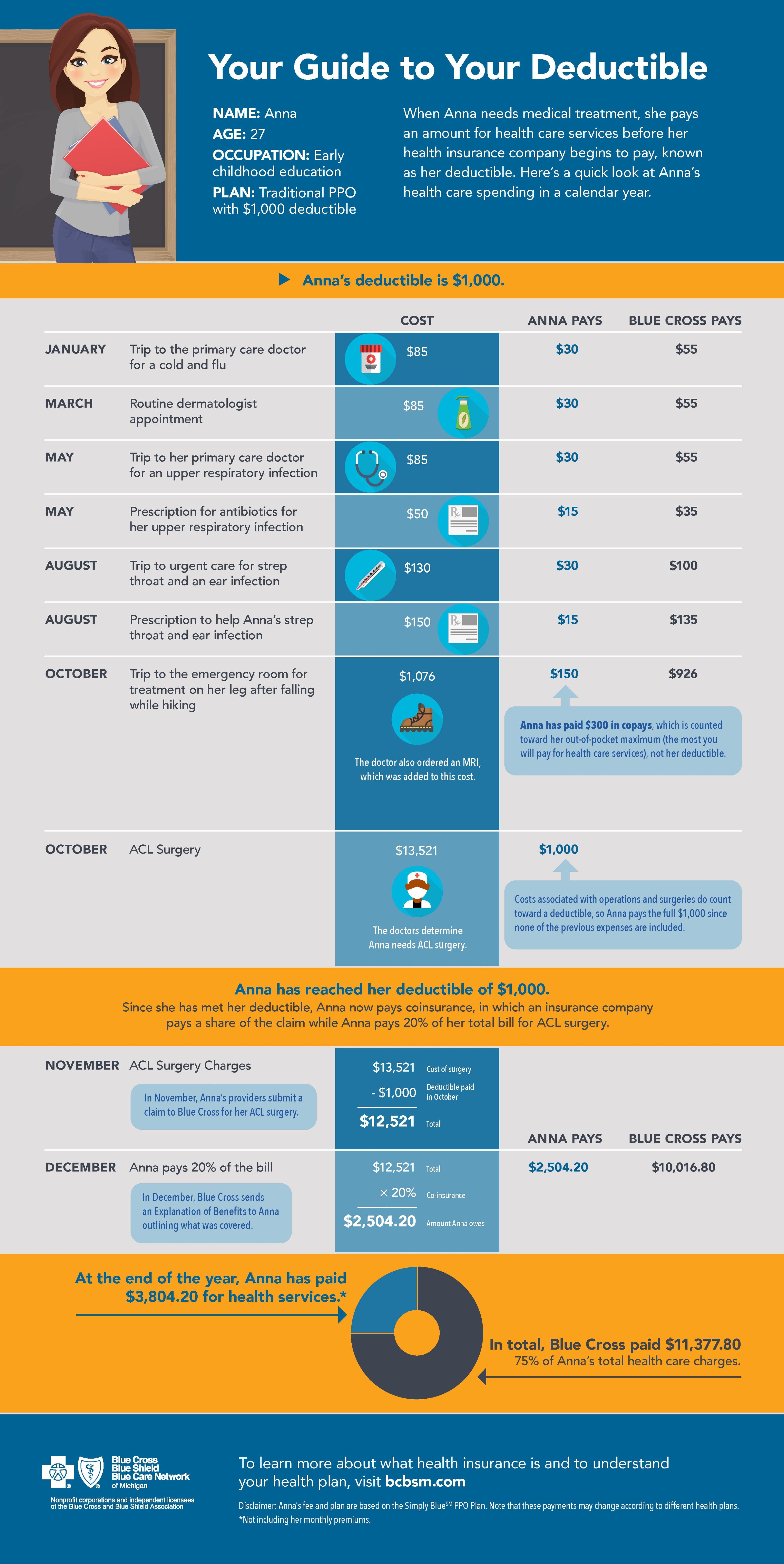

A deductible is the amount you owe for covered health care services before your health care plan begins to make payments to providers for their services. Your insurance provider will have certain things that are considered allowable charges to go toward your deductible, and throughout the year, you will be billed and pay until the deductible is met. After that, you are responsible for the co-insurance amount that is billed up to your out-of-pocket maximum.

Deductible amounts and out-of-pocket maximums vary based on individual plans. Plans with higher deductibles have lower monthly premiums and vice versa. Regardless of which plan you choose, your deductible will reset each year, and insurance will not start payments until the deductible is met again.

You can see your plan’s deductible, out-of-pocket maximums and covered health services by using the Blue Cross Blue Shield of Michigan mobile app. If you're a visual learner, the below infographic walks you through how a deductible works.

To learn more about what health insurance is and to understand your health plan, visit bcbsm.com.

Next time you visit the doctor or pay a health insurance bill, take a look at your deductible and your monthly premium. Doing so can help you budget for better health, determine if your current health plan is right for you and achieve financial success.

Read more:

Photo credit: Getty Images