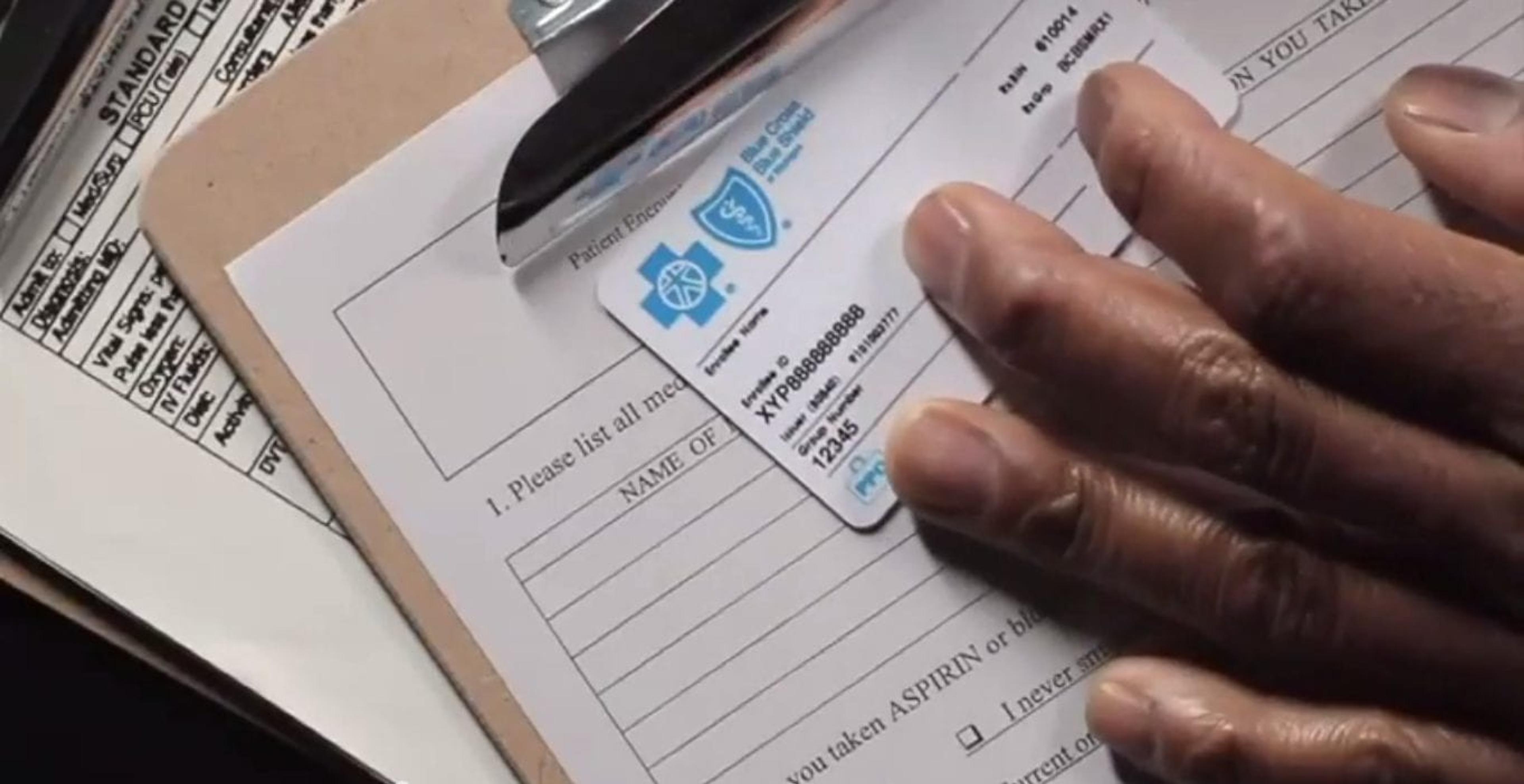

If you want to get the most out of your health insurance, one of the most important things to do is be aware of what your plan offers. Think insurance is just a card to keep in your wallet? You might be surprised. Here are some tips to help you get started: Read Through Welcome Materials: Most insurers send members a welcome kit upon enrollment. Read through it. In addition to covering health care costs, some insurers offer free health education, chronic condition management, self-help books, member discounts and even personal coaches, to help meet health goals. Learn How Your Plan Works: Take some time to learn how your plan works. What does it mean to have an "HMO" or a "PPO"? What are the costs that make up your health plan, and which are you responsible for? Do you understand your prescription coverage? What is an "Explanation of Benefits" and how do you read it? Take Advantage of Preventive Benefits: Too many people make the mistake of only using insurance for an existing illness or injury. Under the Affordable Care Act, many preventive services – such as annual exams and screenings – are included in a health plan at no additional cost. Save money by taking advantage of included benefits. Write Down Important Numbers: With so many things to keep track of these days, writing down phone numbers of doctors, pharmacists and your insurance company – and storing them in an easily accessible place – is a small, but important step in managing your health. There are a variety of resources available through your insurance to help when you need it most. By having this information readily available, members can save money and time. Blue Care Network offers a free and confidential 24-hour advice line allowing members to speak directly with a health professional. Register for an Online Account: If the insurer offers it, use it. Bcbsm.com makes it easy for Blues members to manage their health insurance online. Not only can members review billing information, like medical claims, deductible levels and copays, but they also have benefits like digital health coaching, online podcasts, and self-health articles covering a number of different conditions. Consider a Health Spending Account: Health spending accounts – such as a health savings account (HSA), health reimbursement arrangement (HRA) or flexible spending account (FSA) – are used to save money on medical expenses. They’re part of what’s called consumer-directed health care. “Consumer directed” means they manage more of the money spent – and saved – on health care costs. For more health insurance tips visit bcbsm.com/101 or follow the hashtag #Covered101 on our social channels. If you have a specific question, please submit your query online through our Customer Action Center. Photo Credit: Steve Wall